7 Times Square Tower

New York, New York 10036

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 29, 201126, 2013 at 10:00 a.m., Local Time

The Penn Club

30 West 44th Street

RSUI Group, Inc.

New York, New York945 East Paces Ferry Road, 18th FloorAtlanta, Georgia

Alleghany Corporation (“Alleghany”) hereby gives notice that its 20112013 Annual Meeting of Stockholders will be held at the offices of its subsidiary RSUI Group, Inc., 945 East Paces Ferry Road, 18th Floor, Atlanta, Georgia,The Penn Club, 30 West 44th Street, New York, New York, on Friday, April 29, 201126, 2013 at 10:00 a.m., local time, for the following purposes:

| 1. | To elect | |

| 2. | To | |

| 3. | To hold an advisory, non-binding vote on executive compensation. | |

| 4. | ||

| To transact such other business as may properly come before the meeting, or any adjournment or |

Holders of Alleghany common stock at the close of business on March 7, 20111, 2013 are entitled to receive this Notice and vote for the election of directors and on each of the other matters set forth above at the 20112013 Annual Meeting and any adjournments of this meeting.

You are cordially invited to be present. Ifattend the 2013 Annual Meeting. Representation of your shares at the meeting is very important. Whether or not you do not expectplan to attend in person, we encourage you mayto vote your shares promptly by telephone, by the Internet, or by signing and returning the enclosed proxy card in the envelope provided. Representation of your shares is very important. We ask that you submit your proxy promptly. You may revoke your proxy at any time prior to its beingbefore it is voted at the 2013 Annual Meeting by written notice to the Secretary of Alleghany, by submitting a new proxy with a later date, or by voting in person at the 20112013 Annual Meeting.

| By order of the Board of Directors, |

| CHRISTOPHER K. DALRYMPLE |

Senior Vice President, General Counsel and Secretary |

CHRISTOPHER K. DALRYMPLEVice President, General Counseland Secretary

Important Notice Regarding Internet Availability of Proxy Materials for the Alleghany Corporation 20112013 Annual Meeting of Stockholders to be Held on April 29, 2011: Our proxy26, 2013: Proxy materials relating to our 20112013 Annual Meeting (notice of meeting, proxy statement, proxy and 20102012 Annual Report to Stockholders onForm 10-K) are also available on the Internet. Please go to www.edocumentview.com/YAL to view and obtain the proxy materials online.

7 Times Square Tower

New York, New York 10036

PROXY STATEMENT

20112013 Annual Meeting of Stockholders to be held April 29, 201126, 2013

Alleghany Corporation, referred to in this proxy statement as “Alleghany,” “we,” “our,” or “us,” is providing these proxy materials in connection with the solicitation of proxies by the Board of Directors of Alleghany, or the “Board,” from holders of Alleghany’s outstanding shares of common stock entitled to vote at our 20112013 Annual Meeting of Stockholders, or the “2011“2013 Annual Meeting,” and at any and all adjournments or postponements, for the purposes referred to belowherein and in the accompanying Notice of Annual Meeting of Stockholders. These proxy materials are being mailed to stockholders on or about March 17, 2011.

References to “common stock” in this proxy statement refer to the common stock, par value $1.00 per share, of Alleghany unless the context otherwise requires.

The Board has fixed the close of business on March 7, 20111, 2013 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 20112013 Annual Meeting. Stockholders are entitled to one vote for each share of common stock held of record on the record date with respect to each matter to be acted on at the 20112013 Annual Meeting.

The presence, in person or by proxy, of holders of a majority of the outstanding shares of Alleghany’s common stock is required to constitute a quorum for the transaction of business at the 20112013 Annual Meeting. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its client) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the 20112013 Annual Meeting. Under applicable rules of the New York Stock Exchange, brokers may no longernot use discretionary authority to vote shares of Alleghany’s common stock held for clients on any of the matters to be considered at the 20112013 Annual Meeting other than the ratification of our selection of KPMGErnst & Young LLP as Alleghany’s independent registered public accounting firm. Accordingly, it is important that, if your shares are held by a broker, you provide instructions to your broker so that your votevotes with respect to the election of directors and with respect to the advisory votes on executive compensation and on the frequency of future stockholder advisory votesvote on executive compensation are counted.

There are three ways to vote by proxy: by calling the toll free telephone number on the enclosed proxy card,card; by using the Internet as described on the enclosed proxy cardcard; or by returning the enclosed proxy card in the envelope provided. YouIf your shares are held by a broker you may be able to vote by telephone or the Internet if those options are offered by your shares are held by a broker; follow their instructions.

broker.

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 31 | ||||

COMPENSATION DISCUSSION AND ANALYSIS AND COMPENSATION MATTERS | 32 | |||

| 32 | ||||

Components of | 33 | |||

| 36 | ||||

| 37 | ||||

| 48 | ||||

| 48 | ||||

| 50 | |||

| 54 | ||||

| 60 | ||||

| 61 | ||||

| 72 | ||||

ALL OTHER MATTERS THAT MAY COME BEFORE THE 2013 ANNUAL MEETING | 73 | |||

| 74 | ||||

| 74 | ||||

| 75 |

The following table sets forth suchthe beneficial ownership of common stock of each of the foregoing, as well as other personsperson who, based upon filings made by themsuch person with the U.S. Securities and Exchange Commission, or the “SEC,” werewas the beneficial ownersowner of more than five percent of our outstanding common stock.

| Amount and Nature of Beneficial Ownership(1)(2) | ||||||||||||||||

| Sole Voting | Shared Voting Power | |||||||||||||||

| Name and Address | Power and/or Sole | and/or Shared | Percent | |||||||||||||

of Beneficial Owner | Investment Power | Investment Power | Total | of Class | ||||||||||||

| Estate of F.M. Kirby | 342,712 | 750,479 | 1,093,191 | (3) | 12.5 | |||||||||||

| 17 DeHart Street, P.O. Box 151, Morristown, NJ 07963 | ||||||||||||||||

| Allan P. Kirby, Jr. | 575,583 | — | 575,583 | (4) | 6.6 | |||||||||||

| 14 E. Main Street, P.O. Box 90, Mendham, NJ 07945 | ||||||||||||||||

| Grace Kirby Culbertson | 173,882 | 146,840 | 320,722 | (5) | 3.7 | |||||||||||

| Blue Mill Road, Morristown, NJ 07960 | ||||||||||||||||

| Franklin Mutual Advisers, LLC | 852,297 | — | 852,297 | (6) | 9.7 | |||||||||||

| 101 John F. Kennedy Parkway, Short Hills, NJ 07078 | ||||||||||||||||

| Artisan Partners Limited Partnership | — | 840,550 | 840,550 | (7) | 9.6 | |||||||||||

| 875 E. Wisconsin Avenue, Suite 800, Milwaukee, WI 53202 | ||||||||||||||||

| Royce & Associates, LLC | 585,173 | — | 585,173 | (8) | 6.7 | |||||||||||

| 1414 Avenue of the Americas, New York, NY 10019 | ||||||||||||||||

| Amount and Nature of Beneficial Ownership of Common Stock(1) | ||||||||||||||||

Name and Address of Beneficial Owner | Sole Voting Power and/or Sole Investment Power | Shared Voting Power and/or Shared Investment Power | Total | Percent of Class | ||||||||||||

Davis Selected Advisers, L.P. | 2,054,010 | — | 2,054,010(2) | 12.2 | ||||||||||||

2949 East Elvira Road, Suite 101, Tucson, AZ 85756 | ||||||||||||||||

BlackRock, Inc | 1,064,194 | — | 1,064,194(3) | 6.3 | ||||||||||||

40 East 52nd Street, New York, NY 10022 | ||||||||||||||||

Artisan Partners Holdings LP | — | 982,223 | 982,223(4) | 5.8 | ||||||||||||

875 E. Wisconsin Avenue, Suite 800, Milwaukee, WI 53202 | ||||||||||||||||

| (1) | ||

1

| (2) | According to an amendment dated |

2

| (3) | According to a Schedule 13G statement dated February 4, 2013. |

-1-

| (4) | According to an amendment dated February | |

Pursuant to Alleghany’s Restated Certificate of Incorporation and By-Laws, Alleghany’s Board currently consists of The Board held eight meetings in 2012. Each director who served as a director of Alleghany Alleghany’sthe Board is divided into three separate classes of directors which are required to be as nearly equal in number as practicable. At each Annual Meeting of Stockholders, one class of directors is elected to a term of three years. Currently, there are three standing committees of the Board, consisting of an Audit Committee, Compensation Committee, and Nominating and Governance Committee. Additional information regarding these committees is set out below.eleventwelve directors. AllanUpon the closing of Alleghany’s acquisition of Transatlantic Holdings, Inc., or “Transatlantic,” on March 6, 2012, in accordance with the terms of the merger agreement, three former members of the board of directors of Transatlantic, Stephen P. Kirby, Jr., a directorBradley, Ian H. Chippendale and John G. Foos, were appointed as directors of Alleghany, since 1963, retiredwith one of such new directors being appointed to each of the Board’s three classes.effective as of the 2010 Annual Meeting of Stockholders on April 23, 2010.The Board held seven meetings in 2010. Each directorany time during 2012 attended more than 75% of the aggregate number of meetings of the Board and meetings of the committees of the Board on which he or she served that were held in 2010.2012. There are twothree regularly scheduled executive sessions for non-managementindependent directors of Alleghany and one regularly scheduled executive session for3

-2-

Pursuant to the New York Stock Exchange’s listing standards, Alleghany is required to have a majority of independent directors, and no director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with Alleghany. The Board has determined that Rex D. Adams, Stephen P. Bradley, Karen Brenner, Dan R. Carmichael,Ian H. Chippendale, John G. Foos, Jefferson W. Kirby, William K. Lavin, Thomas S. Johnson, Phillip M. Martineau, James F. Will and Raymond L.M. Wong have no material relationship with Alleghany (either directly or as a partner, shareholder or officer of an organization that has a relationship with Alleghany) other than in their capacities as members of the Board and committees thereof, and thus are independent directors of Alleghany, based upon the fact that none of such directors has any material relationship with Alleghany either directly or as a partner, shareholder or officer of an organization that has a relationship with Alleghany. As a result, nineeleven of Alleghany’s current eleventwelve directors are independent directors. TwoAll of the three director nominees, Ms. Brenner and Messrs. AdamsBradley, Johnson and Jefferson W. Kirby,Will, are independent. The third director nominee, Weston M. Hicks, is President and chief executive officer of Alleghany and is not independent. Prior to his retirementIn addition, Dan R. Carmichael, who retired as a director in April 2010, the Board had determined that Allan P. Kirby, Jr. had no material relationship withof Alleghany other than in his capacityeffective as a member of the Board and committees thereof, and thus was2012 Annual Meeting of Stockholders, qualified as an independent director of Alleghany, based uponduring his service on the fact that he did not have any material relationship with Alleghany either directly or as a partner, shareholder or officer of an organization that has a relationship with Alleghany.

Currently, the positionsposition of Chairman and the position of President and chief executive officer, are separate. It is the policy of the Board that the Chairman should not be an Alleghany officer. The current Chairman is an independent director. Pursuant to the Corporate Governance Guidelines of Alleghany, or the “Corporate Governance Guidelines,” the duties of the Chairman include providing leadership to the Board in managing the business of the Board and ensuring that there is an effective structure for the operation of the Board and its committees. The Board believes that its leadership structure is appropriate given the historical development of the composition of the Board and management, and the Corporate Governance Guidelines, Alleghany’s long-term principal stockholders and the significant tenure of a majority of itsthe Board members.4

The Board oversees risk management directly and through its Audit Committee, Compensation Committee, and Nominating and Governance Committee. In addition, Alleghany management has several committees that it uses group-wide to monitor and manage risk at Alleghany and its subsidiaries, including a Risk Management Committee, Reinsurance Security Committee Investment Committeeand Ethics and Legal Compliance Committee. Alleghany management regularly reports to the Board and, as appropriate, to the committees of the Board on management’s activities and risk tolerances. Each year at the Board’s December or January meeting, the Board receives a formal report on enterprise risk management and, at the same meeting, considers Alleghany’s five-year strategic plan

-3-

financial estimates and the evaluation of the chief executive officer, allowing the Board to consider risk and risk management in the context of theAlleghany’s strategic plan and management’s performance. At the Audit Committee’s June meeting, it receives a formal report on enterprise risk management and legal compliance, which is also copied to the Board, and the Audit Committee subsequently reports thereon to the Board. The Board believes that risk oversight is a responsibility of the entire Board, and it does not look to any individual director or committee to lead it in discharging this responsibility.

Audit Committee The current members of the Audit Committee are Messrs. Lavin (Chairman), Adams, CarmichaelFoos and Wong and Ms. Brenner. The Board has determined that each of these members has the qualifications set forth in the New York Stock Exchange’s listing standards regarding financial literacy and accounting or related financial management expertise, and is an audit committee financial expert as defined by the SEC. The Board has also determined that each of the members of the Audit Committee is independent as defined in the New York Stock Exchange’s listing standards. The Audit Committee operates pursuant to a Charter, a copy of which is available on Alleghany’s website at www.alleghany.com or may be obtained, without charge, upon written request to the Secretary of Alleghany at Alleghany’s principal executive offices. Pursuant to its Charter, the Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm, including approving in advance all audit services and permissible non-audit services to be provided by the independent registered public accounting firm. The Audit Committee is also directly responsible for the evaluation of such firm’s qualifications,5

the audited consolidated annual financial statements of Alleghany and its subsidiaries, including Alleghany’s specific disclosures under management’s discussion and analysis of financial condition and results of operation and critical accounting estimates, to be included in Alleghany’s Annual Report on Form 10-K filed with the SEC and whether to recommend this inclusion;

the unaudited consolidated quarterly financial statements of Alleghany and its subsidiaries, including management’s discussion and analysis thereof, to be included in Alleghany’s Quarterly Reports on Form 10-Q filed with the SEC;

-4-

Alleghany’s policies with respect to risk assessment and risk management;

the adequacy and effectiveness of Alleghany’s internal controls and disclosure controls and procedures;

the compensation, activities and performance of Alleghany’s internal auditor; and

the quality and acceptability of Alleghany’s accounting policies, including critical accounting estimates and practices and the estimates and assumptions used by management in the preparation of Alleghany’s financial statements.

The Audit Committee held sevennine meetings in 2010.

Compensation Committee

The current members of the Compensation Committee are Messrs. CarmichaelWill (Chairman), Chippendale, Johnson, Lavin, Martineau Will and Wong, each of whom the Board has determined is independent as defined in the New York Stock Exchange’s listing standards. The Compensation Committee operates pursuant to a Charter, a copy of which is available on Alleghany’s website at www.alleghany.com or may be obtained, without charge, upon written request to the Secretary of Alleghany at Alleghany’s principal executive offices. Alleghany’s executive compensation program is administered by the Compensation Committee. Pursuant to its Charter, the Compensation Committee is, among other things, charged with:

reviewing and approving the financial goals and objectives relevant to the compensation of the chief executive officer; | ||

6

evaluating the chief executive officer’s performance in light of such goals and objectives; and

In addition, the Compensation Committee also is responsible for reviewing the annual recommendations of the chief executive officer concerning:

the compensation of the other Alleghany officers and proposed adjustments to such officers’ compensation; and

the adjustments proposed to be made to the compensation of the three most highly paid officers of each Alleghany operating subsidiary as recommended by the compensation committee for each such operating subsidiary.

The Compensation Committee provides a report on the actions described above to the Board and makes recommendations with respect to such actions to the Board as the

-5-

Compensation Committee may deem appropriate. Compensation adjustments and awards are generally made annually by the Compensation Committee at a meeting in December or January.

In addition, the Compensation Committee is responsible for reviewing the compensation of the directors on an annual basis, including compensation for service on committees of the Board, and proposing changes, as appropriate, to the Board. The Compensation Committee also administers Alleghany’s 2002 Long-Term Incentive Plan, or the “2002 LTIP,” the 2007 Long-Term Incentive Plan, or the “2007 LTIP,” the 2005 Management2012 Long-Term Incentive Plan, or the “2005 MIP,“2012 LTIP,” and the 2010 Management Incentive Plan, or the “2010 MIP.”

Alleghany’s Senior Vice President-Law, Robert M. Hart,President, General Counsel and Secretary, Christopher K. Dalrymple, supports the Compensation Committee in its work. In addition, during 2010,from January through September 2012, the Compensation Committee engaged Grahall Partners as independent outside compensation consultant. In September 2012, following a competitive process, the Compensation Committee engaged Frederic W. Cook & Co., Inc., or the “Compensation Consultant,” as independent outside compensation consultant to advise it on executive compensation matters. The Compensation Consultant also advised the Compensation Committee and management on various executive compensation matters involving Alleghany’s operating subsidiaries. The Chairman of the Compensation Committee reviews and approves all fees Alleghany pays to the Compensation Consultant.

The Compensation Committee held fiveseven meetings in 2010.

Nominating and Governance Committee

The current members of the Nominating and Governance Committee are Messrs. Adams (Chairman), Bradley, Johnson, Martineau and Will and Ms. Brenner, each of whom the Board has determined is independent as defined in the New York Stock Exchange’s listing standards. The Nominating and Governance Committee operates pursuant to a Charter, a copy of which is available on Alleghany’s website at www.alleghany.com or may be obtained, without charge,

7

identifying and screening director candidates, consistent with criteria approved by the Board;

making recommendations to the Board as to persons to be (i) nominated by the Board for election to the Board by stockholders or (ii) chosen by the Board to fill newly created directorships or vacancies on the Board;

-6-

developing and recommending to the Board a set of corporate governance principles applicable to Alleghany; and

overseeing the evaluation of the Board, individual directors and Alleghany’s management.

The Nominating and Governance Committee will receive at any time and will consider from time to time suggestions from stockholders as to proposed director candidates. In this regard, a stockholder may submit a recommendation regarding a proposed director nominee in writing to the Nominating and Governance Committee in care of the Secretary of Alleghany at Alleghany’s principal executive offices. Any such persons recommended by a stockholder will be evaluated in the same manner as persons identified by the Nominating and Governance Committee.

The Board generally seeks members with diverse business and professional backgrounds and outstanding integrity and judgment, and such other skills and experience as will enhance the Board’s ability to best serve Alleghany’s interests. The Board has not approved any specific criteria for nominees for director nor established a procedure for identifying and evaluating nominees for director. The Board believes that establishing such criteria is best left to an evaluation of Alleghany’s needs at the time that a nomination is to be considered. In view of the infrequency of vacancies on the Board,However, as a general matter, the Nominating and Governance Committee does not have an established procedure forconsider diversity in identifying and evaluating possible nominees for director or any specific qualities, skills or minimum qualifications that it believes are necessary for one or more of Alleghany’s directors to possess. In 2009, at the request of the Board, the Nominating and Governance Committee undertook a process to identify two or more new directors, which process resulted in the elections of Ms. Brenner and Mr. Martineau as directors in December 2009. The Nominating and Governance did consider diversity in setting its 2009 search criteria.

The Nominating and Governance Committee held fiveeight meetings in 2010.

8

-7-

Interested parties may communicate directly with any individual director, the non-managementindependent directors as a group or the Board as a whole by mailing such communication to the Secretary of Alleghany at Alleghany’s principal executive offices. Any such communications will be delivered unopened:

if addressed to a specific director, to such director;

if addressed to the independent directors, to the Chairman of the Nominating and Governance Committee who will report thereon to the independent directors; or

if addressed to the Board, to the Chairman of the Board who will report thereon to the Board.

Alleghany’s retirement policy for directors was adopted by Old Alleghany in 1979 and by Alleghany upon its formation in 1986. In January 2011, the retirement policy was amended to provideprovides that except in respect of directors serving when the policy was first adopted, a director must retire from the Board at the next Annual Meeting of Stockholders following his or her 75th75th birthday. Prior to the January 2011 amendment, the retirement policy had required a director to retire at the next Annual Meeting of Stockholders following his or her 72nd birthday. Mr. Burns is not subject to this retirement policy because he was a director of Old Alleghany in 1979.

The Board has adopted a written Related Party Transaction Policy, or “the Policy.” Pursuant to the Policy, all related party transactions must be approved in advance by the Board. Under the Policy, a related party transaction means any transaction, other than compensation for services as an officer or director authorized and approved by the Compensation Committee or the Board, in which Alleghany or any of its subsidiaries is a participant and in which any:

director or officer of Alleghany or | ||

9

immediate family member of such director or officer, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law and any person (other than a tenant or employee) sharing the household of such director or officer,

-8-

if such interest arises only from such person’s position as a director of another corporationand/or such person’s direct and indirect ownership of less than 10% of the equity of such firm, corporation, or other entity.

Under the Policy, all newly proposed related party transactions are referred to the Nominating and Governance Committee for review and consideration of its recommendation to the Board. Following this review, the related party transaction and the Nominating and Governance Committee’s analysis and recommendations are presented to the full Board (other than any directors interested in the transaction) for approval. The Nominating and Governance Committee reviews existing related party transactions annually, with the goals of ensuring that such transactions are being pursued in accordance with all of the understandings and commitments made at the time they were approved, ensuring that payments being made with respect to such transactions are appropriately reviewed and documented, and reaffirming that such transactions remain in the best interests of Alleghany. The Nominating and Governance Committee reports any such findings to the Board.

Upon the closing of the acquisition of Transatlantic on March 6, 2012, Joseph P. Brandon was named Executive Vice President of Alleghany. During the period from September 15, 2011 through the closing date, Mr. Brandon was engaged by Alleghany as a consultant. Mr. Brandon was paid consulting fees of $400,000 during fiscal 2012.

Alleghany has adopted a Financial Personnel Code of Ethics for its chief executive officer, chief financial officer, chief accounting officer, vice president for tax matters and all professionals serving in a finance, accounting, treasury or tax role, and a Code of Ethics and Business Conduct for its directors, officers and employees, and the Corporate Governance Guidelines. Copies of each of these documents are available on Alleghany’s website at www.alleghany.com or may be obtained, without charge, upon written request to the Secretary of Alleghany at Alleghany’s principal executive offices.

-9-

Alleghany’s By-Laws provide for a majority voting standard for the election of directors for uncontested elections. In connection with such provision of the By-Laws, the Corporate Governance Guidelines provide that a director nominee, as a condition of his or her nomination, shall tender to the Board, at the time of nomination, an irrevocable resignation in the event that the director fails to receive the majority vote required by the By-Laws, effective upon the Board’s acceptance of such resignation. In the event that a director nominee fails to receive the requisite majority vote, the Nominating and Governance Committee will evaluate10

the director’s qualifications;

the director’s past and expected future contributions to Alleghany;

the overall composition of the Board; and

whether accepting the tendered resignation would cause Alleghany to fail to meet any applicable rule or regulation (including the New York Stock Exchange’s listing standards and federal securities laws).

The Board, by vote of independent directors other than the director whose resignation is being evaluated, will act on the tendered resignation and will publicly disclose its decision and rationale within 90 days following certification of the stockholder vote.

Directors are expected to achieve ownership of common stock, or equivalent common stock units, with ahaving an aggregate value (based upon the higher of market value or book value) equal to at least five times the annual board retainer within five years of election to the Board, and to maintain such a level thereafter.

11

-10-

The following table sets forth, as of March 7, 2011,1, 2013, the beneficial ownership of common stock of each of the nominees named for election as a director, each of the other current directors, each of the executive officers named in the Summary Compensation Table on page 54,50, and all nominees, directors and executive officers as a group.

| Amount and Nature of Beneficial Ownership | ||||||||||||||||

| Sole Voting | Shared Voting Power | |||||||||||||||

| Power and/or Sole | and/or Shared | Percent | ||||||||||||||

Name of Beneficial Owner | Investment Power | Investment Power | Total | of Class | ||||||||||||

| Rex D. Adams | 9,338 | — | 9,338 | (1) | 0.11 | |||||||||||

| Weston M. Hicks | 79,377 | — | 79,377 | (2) | 0.91 | |||||||||||

| Jefferson W. Kirby | 68,983 | 159,096 | 228,079 | (1)(3) | 2.6 | |||||||||||

| Karen Brenner | 416 | — | 416 | (1) | * | |||||||||||

| John J. Burns, Jr. | 61,189 | — | 61,189 | (1)(4) | 0.70 | |||||||||||

| Dan R. Carmichael | 22,374 | — | 22,374 | (1)(5) | 0.26 | |||||||||||

| Thomas S. Johnson | 10,563 | — | 10,563 | (1) | 0.12 | |||||||||||

| William K. Lavin | 9,435 | — | 9,435 | (1) | 0.11 | |||||||||||

| Phillip M. Martineau | 416 | — | 416 | (1) | * | |||||||||||

| James F. Will | 18,891 | 1,683 | 20,574 | (1) | 0.24 | |||||||||||

| Raymond L.M. Wong | 4,208 | — | 4,208 | (1) | 0.05 | |||||||||||

| Roger B. Gorham | 9,161 | — | 9,161 | (6) | 0.11 | |||||||||||

| Robert M. Hart | 12,806 | — | 12,806 | (7) | 0.15 | |||||||||||

| Jerry G. Borrelli | 1,262 | — | 1,262 | 0.01 | ||||||||||||

| Christopher K. Dalrymple | 1,465 | — | 1,465 | 0.02 | ||||||||||||

| All nominees, directors and executive officers as a group (15 persons) | 309,884 | 160,779 | 470,663 | (8) | 5.4(9) | |||||||||||

| Amount and Nature of Beneficial Ownership of Common Stock | ||||||||||||||||

Name of Beneficial Owner | Sole Voting Power and/or Sole Investment Power | Shared Voting Power and/or Shared Investment Power | Total | Percent of Class | ||||||||||||

Rex D. Adams | 8,672 | — | 8,672(1) | * | ||||||||||||

Jerry G. Borrelli | 1,325 | — | 1,325 | * | ||||||||||||

Stephen P. Bradley | 417 | — | 417(1) | * | ||||||||||||

Joseph P. Brandon | 20,160 | — | 20,160(2) | * | ||||||||||||

Karen Brenner | 2,515 | — | 2,515(1) | * | ||||||||||||

Ian H. Chippendale | 417 | — | 417(1) | * | ||||||||||||

Christopher K. Dalrymple | 1,902 | — | 1,902 | * | ||||||||||||

John G. Foos | 1,065 | — | 1,065(1) | * | ||||||||||||

Roger B. Gorham | 6,732 | — | 6,732 | * | ||||||||||||

Weston M. Hicks | 60,601 | — | 60,601(3) | * | ||||||||||||

Thomas S. Johnson | 9,874 | — | 9,874(1) | * | ||||||||||||

Jefferson W. Kirby | 103,445 | 396,131 | 499,576(1)(4) | 2.97 | ||||||||||||

William K. Lavin | 8,199 | — | 8,199(1) | * | ||||||||||||

Phillip M. Martineau | 2,224 | — | 2,224(1) | * | ||||||||||||

James F. Will | 18,649 | 1,716 | 20,365(1)(5) | * | ||||||||||||

Raymond L.M. Wong | 6,915 | — | 6,915(1)(6) | * | ||||||||||||

All nominees, directors and executive officers as a group (16 persons) | 253,112 | 397,847 | 650,959 | 3.87 | (7) | |||||||||||

| * | represents less than | |

| (1) | Includes |

-11-

| “2005 Directors’ Plan,” and the 2000 Directors’ |

12

| Stock Option Plan, or the “2000 Directors’ Plan. | ||

| (2) | ||

| (3) | Includes |

| (4) | Includes 159,097 shares of common stock held by trusts of which Mr. Kirby is co-trustee and |

| (5) | Includes |

| (6) | Includes 200 shares of common stock owned by Mr. | |

| (7) | ||

| Based on the number of shares of outstanding common stock as of March |

13

-12-

Alleghany has determined that, except as set forth below, no person who at any time during 20102012 was a director, officer or beneficial owner of more than 10% of common stock failed to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934, as amended, during 2010.2012. This determination is based solely upon Alleghany’s review of Forms 3, 4 and 5, and written representations that no Form 5 was required, which such persons submitted to Alleghany during or with respect to 2010. Mr. F.M. Kirby2012. Joseph P. Brandon filed a Form 4 report on May 19, 2010November 9, 2012 reporting one transaction that occurred on September 3, 2012. Stephen P. Bradley filed a distribution of 2,204 shares of common stock paid by Alleghany as a stock dividend inForm 5 on January 22, 2013 reporting one transaction that occurred on April 2010 to beneficiaries of a trust of which Mr. Kirby was sole trustee.

14

-13-

PROPOSAL 1. ELECTION OF DIRECTORS

Proxies received from Alleghany stockholders of record will be voted for the election of the threefour nominees named above as Alleghany directors unless such stockholders indicate otherwise. If any of the foregoing nominees is unable to serve for any reason, which is not anticipated, the shares represented by proxy may be voted for such other person or persons as may be determined by the holders of such proxy unless stockholders indicate otherwise. A nominee for director shall be elected to the Board if such nominee receives the affirmative vote of a majority of the votes cast with respect to the election of such nominee. A majority of votes cast means the number of votes cast “for” a nominee’s election must exceed the number of votes cast “against” the nominee’s election. Abstentions and broker non-votes (see “Information About Voting”) do not count as votes cast “for” or “against” the nominee’s election. Abstentions and broker non-votes will be counted as present at the meeting for quorum purposes.

-14-

The following information includes the age, the year in which first elected as a director of Alleghany, or Old Alleghany, the principal occupationand/or other business experience for the past five years, other public company directorships during the past five years, and the experience, qualifications, attributes and skills of each of the nominees named for election as director, and of each of the other directors of Alleghany. In addition to the information presented below regarding the specific experience, qualifications, attributes and skills that led the Board to the conclusion that each of the nominees named for election as director should be elected as a director of Alleghany, Alleghany believes that each of the nominees, and each of the other directors of Alleghany, has a reputation for integrity, honesty and for adherence to high ethical standards. Alleghany also believes that each of the nominees named for election as director, and each of the other directors of Alleghany, has demonstrated business acumen

15

Stephen P. Bradley Age 71 Director since Member of the Governance Committee Term expires in |   | Mr. Mr. | ||

|

16

|

-15-

Karen Brenner Age Director since |  |

17

Member of the Audit Committee |  | |||

|

18

| ||||

Member of the Nominating and Governance Term expires in 2013 |   | Ms. Brenner has been Ms. Brenner’s qualifications to serve on the Alleghany Board also include her years of business experience as |

19

Thomas S. Johnson Age Director since 1997 and for1992-1993 Member of the Committee Member of the Nominating and Governance Committee Term expires in 2013 |   | Mr. Johnson was Chairman and Chief Executive Mr. Johnson’s qualifications to serve on the | ||

20

-16-

James F. Will Age Director since Chairman of the Compensation Committee Member of the Nominating and Governance Committee Term expires in 2013 |   |

21

| Mr. Will was the President of Saint Vincent College from July 2000 until his retirement in June 2006, at which time he was named Vice Chancellor and President Emeritus of Saint Vincent College. Mr. Will’s qualifications to serve on the Alleghany Board also include his over 20 years of experience as an executive in the steel industry, particularly his tenure as President and Chief Executive Officer of Armco Inc., a steel manufacturing and metals processing company, and his experience as President of Saint Vincent College. |

Rex D. Adams Age 73 Director since 1999 Chairman of the Nominating and Governance Committee Member of the Audit Committee Term expires in 2014 |  | Mr. Adams has been a director and Chairman Mr. Adams’ qualifications to serve on the |

-17-

Ian H. Chippendale Age 64 Director since 2012 Member of the Compensation Committee Term expires in 2014 |  | Mr. Chippendale is the retired Chairman (from September 2003 to December 2006) of RBS Insurance Group, Ltd., an insurance company. In addition, Mr. Chippendale has served as a director of HomeServe plc since January 2007 and was a director of Transatlantic prior to March 6, 2012. Mr. Chippendale’s qualifications to serve on the Alleghany Board also include his insurance industry knowledge and his international experience, including his service as the Chairman of RBS Insurance Group, Ltd. | ||

Weston M. Hicks Age 56 Director since 2004 Term expires in 2014 |  | Mr. Hicks has been Alleghany’s President and Mr. Hicks’ qualifications to serve on the | ||

Jefferson W. Kirby Age 51 Director since 2006 Term expires in 2014 |  | Mr. Kirby has been Chairman of the Board of Alleghany since July 2010. Mr. Kirby has been the Managing Member of Broadfield Capital Management, LLC, an investment advisory services company, since July 2003. Mr. Kirby also currently serves as a director of Somerset Hills Bancorp. Mr. Kirby’s qualifications to serve on the Alleghany Board also include his over 20 years of experience in financial services and investment management, including his service as a Vice President of Alleghany from 1994 to June 2003 and as an investment manager. | ||

John G. Foos Age 63 Director since 2012 Member of the Audit Committee Term expires in 2015 |  | Mr. Foos was Chief Financial Officer of Mr. Foos’ qualifications to serve on the | ||

William K. Lavin Age 68 Director since 1992 Chairman of the Audit Committee Member of the Compensation Committee Term expires in 2015 |  | Mr. Lavin has been a financial consultant since October 1994, and currently serves as a director of Artisanal Brands, Inc. Mr. Lavin’s qualifications to serve on the Alleghany Board also include his business experience as an executive with public and private companies, his extensive experience with public and financial accounting matters for such companies, and his financial literacy. | ||

-19-

Phillip M. Martineau Age 65 Director since 2009 Member of the Compensation Committee Member of the Nominating and Governance Committee Term expires in 2015 |  | Mr. Martineau has been Chairman, President Mr. Martineau’s qualifications to serve on the | ||

Raymond L.M. Wong Age 60 Director since 2006 Member of the Audit Committee Member of the Compensation Committee Term expires in 2015 |  | Mr. Wong is currently a Managing Director of Spring Mountain Capital, LP, an investment management company which he joined in 2007. Prior to that, from 2002 until 2007, Mr. Wong was the Managing Member of DeFee Lee Pond Capital LLC, a financial advisory and private investment company. Mr. Wong’s qualifications to serve on the Alleghany Board also include his business experience, particularly his 25 years as a managing director in the investment banking group of Merrill Lynch & Co., Inc., and his financial literacy. | ||

-20-

The information under this heading relates to the compensation during 2012 Director CompensationCOMPENSATION OF DIRECTORSCompensation of Directors20102012 of those personsnon-employee directors who served as directors of Alleghanyon the Board at any time during 2010, except for Mr. Hicks, whose compensation is reflected in the Summary Compensation Table on page 54.20102012. Fees Earned Stock Option or Paid Awards Awards All Other in Cash (1) (2) Compensation(3) Total Rex D. Adams $ 72,000 $ 75,180 $ 66,252 — $ 213,432 Karen Brenner $ 66,000 $ 75,180 $ 66,252 — $ 207,432 John J. Burns, Jr. $ 300,000 $ 75,180 $ 66,252 $ 28,530 $ 469,962 Dan R. Carmichael $ 75,000 $ 75,180 $ 66,252 — $ 216,432 Thomas S. Johnson $ 60,750 $ 75,180 $ 66,252 — $ 202,182 Allan P. Kirby, Jr.(4) $ 16,500 — — — $ 16,500 Jefferson W. Kirby $ 75,000 $ 75,180 $ 66,252 — $ 216,432 William K. Lavin $ 85,000 $ 75,180 $ 66,252 — $ 226,432 Phillip M. Martineau $ 63,500 $ 75,180 $ 66,252 — $ 204,932 James F. Will $ 60,000 $ 75,180 $ 66,252 — $ 201,432 Raymond L.M. Wong $ 64,000 $ 75,180 $ 66,252 — $ 205,432

Name | Fees Earned or Paid in Cash | Stock Awards (1) | Option Awards (2) | All Other Compensation(3) | Total | |||||||||||||||

Rex D. Adams | $ | 67,000 | $ | 85,463 | $ | 69,950 | — | $ | 222,413 | |||||||||||

Stephen P. Bradley | $ | 56,287 | $ | 85,463 | $ | 69,950 | — | $ | 211,700 | |||||||||||

Karen Brenner | $ | 62,000 | $ | 85,463 | $ | 69,950 | — | $ | 217,413 | |||||||||||

John J. Burns, Jr.(4) | $ | 66,667 | — | — | $ | 39,863 | $ | 106,530 | ||||||||||||

Dan R. Carmichael(5) | $ | 15,000 | — | — | — | $ | 15,000 | |||||||||||||

Ian H. Chippendale | $ | 57,787 | $ | 85,463 | $ | 69,950 | — | $ | 213,200 | |||||||||||

John G. Foos | $ | 60,287 | $ | 85,463 | $ | 69,950 | — | $ | 215,700 | |||||||||||

Thomas S. Johnson | $ | 57,000 | $ | 85,463 | $ | 69,950 | — | $ | 212,413 | |||||||||||

Jefferson W. Kirby | $ | 140,000 | $ | 85,463 | $ | 69,950 | — | $ | 295,413 | |||||||||||

William K. Lavin | $ | 80,000 | $ | 85,463 | $ | 69,950 | — | $ | 235,413 | |||||||||||

Phillip M. Martineau | $ | 57,000 | $ | 85,463 | $ | 69,950 | — | $ | 212,413 | |||||||||||

James F. Will | $ | 59,500 | $ | 85,463 | $ | 69,950 | — | $ | 214,913 | |||||||||||

Raymond L.M. Wong | $ | 65,000 | $ | 85,463 | $ | 69,950 | — | $ | 220,413 | |||||||||||

| (1) | Represents the grant date fair value of the award of 250 shares of restricted common stock or 250 restricted stock units (each equivalent to one share of common stock) made to eachnon-employee director under the 2010 Directors’ Plan on April | |

| (2) | Represents the grant date fair value dollar amount of a stock option for 500 shares of common stock made to each non-employee director under the 2010 Directors’ Plan on April | |

-21-

| (3) | Reflects a payment of |

23

| pursuant to Alleghany’s life insurance program in which retired Alleghany officers are eligible to participate, and a payment of | ||

| (4) | Mr. |

| (5) | Mr. Carmichael retired as a director in April 2012 and did not receive any awards of restricted stock, restricted stock units or stock options during 2012. |

Fees Earned or Paid in Cash

In addition to the fees paid to directors for their service on committees, as described below, each director who is not an Alleghany officer or serving as Chairman or Vice Chairman of the Board receives an annual retainer of $40,000, payable in cash. The Chairman of the Board receives an annual retainer of $140,000. Arrangements with the Vice Chairman of the Board, including an annual retainer of $200,000, payable in cash, are described below. The Chairman of the Audit Committee receives an annual fee of $30,000, and each other member receives an annual fee of $15,000. The Chairman of the Compensation Committee receives an annual fee of $15,000, and each other member receives an annual fee of $10,000. The Chairman of the Nominating and Governance Committee receives an annual fee of $12,000, and each other member receives an annual fee of $7,000.

Stock Awards and Option Awards

Pursuant to the 2010 Directors’ Plan, each year as of the first business day following the Annual Meeting of Stockholders, each individual who was elected, re-elected or continues as a member of the Board and who is not an employee of Alleghany or any of its subsidiaries receives:

a stock option to purchase 500 shares of common stock, subject to anti-dilution adjustments, at an exercise price equal to the fair market value on the date of grant; and

at the individual director’s election, either (i) 250 shares of restricted common stock or (ii) 250 restricted stock units, each equivalent to one share of common stock, which are subject to potential forfeiture until the first Annual Meeting of Stockholders following the date of grant, and restrictions upon transfer until the third anniversary of the date of grant.

-22-

On April 26, 2010,30, 2012, each eligible director received a stock option to purchase 500 shares of common stock at an exercise price of $300.72$341.85 per share and either (i) 250 shares of restricted common stock or (ii) 250 restricted stock units. Each director is permitted to defer

24

Arrangements with the Former Vice Chairman of the Board

Mr. Burns was Chairman of the Board from January 2, 2007 through June 30, 2010. Subsequent to the election of Mr. Jefferson W. Kirby as2010 and Vice Chairman of the Board effectivefrom July 1, 2010 Mr. Burns has remained on the Board as Vice Chairman and a director.through April 27, 2012. For his service as Vice Chairman of the Board, Mr. Burns receivesreceived an annual retainer of $200,000 in cash. Commencing in 2011, Mr. Burns has waived his rights to receive future awards under the 2010 Directors’ Plan and any successor plans thereto. Mr. Burns previously received an annual retainer of $400,000 in cash for his service as Chairman of the Board. Commencing in 2011, Mr. Burns waived his rights to receive awards under the 2010 Directors’ Plan and any successor plans thereto. In 2004, Alleghany established an office in New Canaan, Connecticut which Mr. Burns usesused as his principal office for purposes of attending to Alleghany-related matters. As Mr. Burns also usesused this office to attend to personal matters, commencingsince July 1, 2010, Mr. Burns reimbursesreimbursed Alleghany for fifty percent of the annual rent and operating costs for this office, amounting to $20,500 for the period from July 1, 2010 through December 31, 2010 and estimated to amount to approximately $41,000$15,256 for calendar year 2011.2012 through June 30, 2012. Mr. Burns assumed the lease for this office and all associated costs on July 1, 2012. During the period that Mr. Burns served as Chairman of the Board, he reimbursed Alleghany for twenty-five percent of the annual rent and operating costs for this office. The amount of such reimbursement for the period from January 1, 2010 through June 30, 2010 was $11,000.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS SET FORTH IN THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE. EACH NOMINEE SHALL BE ELECTED BY THE AFFIRMATIVE VOTE OF A MAJORITY OF THE VOTES CAST WITH RESPECT TO THE ELECTION OF SUCH NOMINEE. A MAJORITY OF VOTES CAST MEANS THE NUMBER OF VOTES CAST “FOR” A NOMINEE’S ELECTION MUST EXCEED THE NUMBER OF VOTES CAST “AGAINST” THE NOMINEE’S ELECTION. ABSTENTIONS AND BROKER NON-VOTES (SEE “INFORMATION ABOUT VOTING”) DO NOT COUNT AS VOTES CAST “FOR” OR “AGAINST” THE NOMINEE’S ELECTION.

25

-23-

PROPOSAL 2. RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2013

Change in Independent Registered Public Accounting Firm

On February 13, 2012, following a competitive process undertaken by the Audit Committee, the Audit Committee approved the selection of E&Y to serve as Alleghany’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

Prior to the engagement of E&Y, KPMG LLP (“KPMG”) had been Alleghany’s independent auditors. KPMG was notified on February 13, 2012 that it would not be retained as Alleghany’s independent registered public accounting firm for the fiscal year ending December 31, 2012. KPMG’s engagement as Alleghany’s independent registered public accounting firm to audit Alleghany’s consolidated financial statements for the fiscal year ended December 31, 2011, was unaffected by the selection of E&Y, as KPMG’s dismissal became effective on February 24, 2012, following the completion of KPMG’s audit of Alleghany’s consolidated financial statements as of and for the fiscal year ended December 31, 2011 and the filing of the related Annual Report on Form 10-K.

During the two fiscal years ended December 31, 2011 and 2010, and the subsequent interim period through the filing of Alleghany’s Form 10-K for the fiscal year ended December 31, 2011 on February 24, 2012, there were (i) no disagreements between Alleghany and KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference thereto in their reports on the consolidated financial statements for such years, and (ii) no “reportable events” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

-24-

During the two fiscal years ended December 31, 2011 and 2010, and the subsequent interim period through February 24, 2012, Alleghany did not consult with E&Y regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on Alleghany’s consolidated financial statements, and neither a written report was provided to Alleghany nor oral advice was provided that E&Y concluded was an important factor considered by Alleghany in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a “disagreement,” as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a “reportable event,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

Alleghany provided KPMG with a copy of a Form 8-K/A disclosing the above matters, which was filed on February 28, 2012. KPMG furnished Alleghany with a letter addressed to the SEC stating that KPMG agreed with the statements made in the Form 8-K/A, except that KPMG was not in a position to agree or disagree with Alleghany’s statement that E&Y’s engagement was approved by the Audit Committee or with Alleghany’s statement that E&Y was not engaged regarding the application of accounting principles to a specified transaction or the type of audit opinion that might be rendered on Alleghany’s consolidated financial statements, or the effectiveness of internal control over financial reporting. A copy of such letter, dated February 28, 2012, was filed as Exhibit 16 to the Form 8-K/A.

2012 and 2011 Fees

The following table summarizes the fees (i) for professional audit services rendered by E&Y for the audit of Alleghany’s 2012 annual consolidated financial statements and (ii) E&Y incurred for other services rendered to Alleghany for 2012. In addition, the table summarizes the fees (i) for professional audit services rendered by KPMG LLP for the audit of Alleghany’s 2011 annual consolidated financial statements and fees(ii) KPMG LLP billedincurred for other services rendered to Alleghany for 2010 and 2009:

| 2010 | 2009 | |||||||

| Audit Fees | $ | 2,363,418 | $ | 2,449,101 | ||||

| Audit-Related Fees | 112,239 | 7,400 | ||||||

| Tax Fees | — | — | ||||||

| All Other Fees | 1,796 | 1,500 | ||||||

| Total | $ | 2,477,453 | $ | 2,458,001 | ||||

| 2012 | 2011 | |||||||

| E&Y | KPMG | |||||||

Audit Fees | $ | 3,170,000 | $ | 2,369,470 | ||||

Audit-Related Fees | 150,000 | 166,000 | ||||||

Tax Fees | 289,278 | — | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

Total | $ | 3,609,278 | $ | 2,535,470 | ||||

-25-

The amounts shown for “Audit Fees” represent the aggregate fees for professional services E&Y and KPMG LLP rendered for the audit of Alleghany’s annual consolidated financial statements for each of the last two fiscal years, the reviews of Alleghany’s financial statements included in its Quarterly Reports onForm 10-Q, and the services provided in connection with statutory and regulatory filings during each of the last two fiscal years. “Audit Fees” also include fees for professional services E&Y and KPMG LLP rendered for the audit of the effectiveness of internal control over financial reporting. The amounts shown for “Audit-Related Fees” represent the aggregate fees E&Y and KPMG LLP billedincurred for each of the last two fiscal years for assurance and related services that are reasonably related to the performance of the audit or

26

Pre-Approval Policies and Procedures

Audit and permissible non-audit services that KPMG LLPAlleghany’s independent registered public accounting firm may provide to Alleghany must be pre-approved by the Audit Committee or, between meetings of the Audit Committee, by its Chairman pursuant to authority delegated by the Audit Committee. The Chairman reports all pre-approval decisions made by him at the next meeting of the Audit Committee, and he has undertaken to confer with the Audit Committee to the extent that any engagement for which his pre-approval is sought is expected to generate fees for KPMG LLPthe independent registered public accounting firm in excess of $100,000. When considering KPMG LLP’sthe independence of the independent registered public accounting firm, the Audit Committee considered,considers, among other matters, whether KPMG LLP’sthe provision of non-audit services by the independent registered public accounting firm to Alleghany is compatible with maintaining the independence of KPMG LLP.the independent registered public accounting firm. All audit and permissible non-audit services rendered in 20102012 and 20092011 were pre-approved pursuant to these procedures.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE. THIS PROPOSAL SHALL BE ADOPTED BY THE AFFIRMATIVE VOTE OF A MAJORITY OF THE VOTES CAST ON THIS PROPOSAL.

27

-26-

The Audit Committee is currently composed of the five independent directors whose names appear at the end of this report. Management is responsible for Alleghany’s internal controls and the financial reporting process. Alleghany’s independent registered public accounting firm is responsible for performing an independent audit of Alleghany’s annual consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The Audit Committee’s responsibility is to monitor and review these processes and the activities of Alleghany’s independent registered public accounting firm. The Audit Committee members are not acting as professional accountants or auditors, and their responsibilities are not intended to duplicate or certify the activities of management and the independent registered public accounting firm or to certify the independence of the independent registered public accounting firm under applicable rules.

For fiscal 2012, Ernst & Young LLP acted as Alleghany’s independent registered public accounting firm. In this context, the Audit Committee has met to review and discuss Alleghany’s audited consolidated financial statements as of December 31, 20102012 and for the fiscal year then ended, including Alleghany’s specific disclosure under management’s discussion and analysis of financial condition and results of operations and critical accounting estimates, with management and KPMGErnst & Young LLP, Alleghany’s independent registered public accounting firm. The Audit Committee has discussed with KPMGErnst & Young LLP the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200T. KPMGErnst & Young LLP reported to the Audit Committee regarding the critical accounting estimates and practices and the estimates and assumptions used by management in the preparation of the audited consolidated financial statements as of December 31, 20102012 and for the fiscal year then ended, all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, the ramifications of use of such alternative treatments and the treatment preferred by KPMGErnst & Young LLP.

Ernst & Young LLP provided a report to the Audit Committee describing KPMGErnst & Young LLP’s internal quality-control procedures and related matters. KPMGErnst & Young LLP also provided to the Audit Committee the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding KPMGErnst & Young LLP’s communications with the Audit Committee concerning independence, and the Audit Committee discussed with KPMGErnst & Young LLP its independence. When considering KPMGErnst Young LLP’s independence, the Audit Committee considered, among other matters, whether KPMGErnst & Young LLP’s provision of non-audit services to Alleghany is compatible with

-27-

maintaining the independence of KPMGErnst & Young LLP. All audit and permissible non-audit services in 20102012 and 20092011 were pre-approved pursuant to these procedures.

28

William K. Lavin

Rex D. Adams

Karen Brenner

John G. Foos

Raymond L.M. Wong

Audit Committee

of the Board of Directors

29

-28-

Name | Age | Current Position (date elected) | Prior Business Experience | |||

| Weston M. Hicks | 56 | President, chief executive officer (since December 2004) | Executive Vice President, Alleghany (October 2002 to December 2004). | |||

| Joseph P. Brandon | 54 | Executive Vice President (since March 2012) | Consultant to Alleghany (September 2011 to March 2012); private investor (May 2008 to August 2011); Chairman and Chief Executive Officer, General Re Corporation, a property and casualty reinsurer and a wholly-owned subsidiary of Berkshire Hathaway Inc. (September 2001 to April 2008). | |||

| Christopher K. Dalrymple | 45 | Senior Vice President (since January 2012) — General Counsel (since July 2009) and Secretary (since January 2011) | Vice President, Alleghany (December 2004 to January 2012) — Associate General Counsel, Alleghany (March 2002 to July 2009) and Assistant Secretary, Alleghany (March 2002 to January 2011). | |||

-29-

Name | Age | Current Position (date elected) | Prior Business Experience | |||

| Roger B. Gorham | 50 | Senior Vice President — Finance and Investments and acting chief financial officer (since January 2006)(1) | Senior Vice President — Finance and chief financial officer, Alleghany (May 2005 to January 2006); Senior Vice President — Finance, Alleghany (December 2004 to May 2005). | |||

| Jerry G. Borrelli | 47 | Vice President — Finance and chief accounting officer (since July 2006) | Vice President — Finance, Alleghany (February 2006 to July 2006). | |||

| (1) | On January 18, 2013, Alleghany determined to expand its executive leadership team by separating the role of chief financial officer from management of Alleghany’s fixed income portfolio. Accordingly, Mr. Gorham will assume overall responsibility for Alleghany’s fixed income portfolio. Mr. Gorham will serve as Alleghany’s Senior Vice President and chief financial officer until a successor is identified, at which time Mr. Gorham will be named as Senior Vice President — Head of Fixed Income and Treasurer. |

-30-

The Compensation Committee has met to review and Christopher K. Dalrymple, all of whom are named indiscuss with Alleghany’s management the Summaryspecific disclosure contained under the heading “Compensation Discussion and Analysis and Compensation TableMatters” appearing on page 54. As described below inpages 32 through 71 below. Based on its review and discussions with management regarding such disclosure, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis section ofand Compensation Matters be included in this proxy statement we seekand incorporated by reference in Alleghany’s Annual Report on Form 10-K for the year ended December 31, 2012.

James F. Will

Ian H. Chippendale

Thomas S. Johnson

William K. Lavin

Phillip M. Martineau

Raymond L.M. Wong

Compensation Committee

of the Board of Directors

-31-

COMPENSATION DISCUSSION AND ANALYSIS

AND COMPENSATION MATTERS

Compensation Philosophyand Objectives

Our corporate objective is to increase bookcreate stockholder value through the ownership and management of a small group of operating subsidiaries and investments. The intent of our executive compensation program is to provide competitive total compensation to our Named Executive Officers (as defined on page 29) in a manner that links their interests with the interests of our stockholders in creating and preserving stockholder value. In addition, our compensation program is intended to support our strategic objective of increasing common stockholders’ equity per share at double digit rates of 7-10% over the long term without employing excessive amounts of financial leverage and without taking risks that we do not deem prudent. We believe that such management ofimprudent risks. This approach enables us to manage risk is required in order to avoid loss of capital during periods of economic turmoil, which we believe creates maximum value for stockholders in the long run even if it results in lower levels of capital appreciation during periods when economic conditions are more favorable.

The intentfoundation of our executive compensation program is to provide competitive totalrests on the following principles that we believe align our compensation to our named executive officers on a basis that links their interestsprogram with the interests of our stockholdersstockholders:

A significant portion of our Named Executive Officer direct compensation (salary, annual incentive compensation, long-term incentive compensation and savings benefit) is tied to our financial performance. In 2012, approximately 75% of Mr. Hicks’ direct compensation, and at least 50% of the direct compensation for each of our other Named Executive Officers, depended upon our financial performance.

Individual awards under our short and long-term incentive plans are “capped” and performance goals are set at realistic levels to eliminate the potential for unintended windfalls and to avoid encouraging the use of excessive financial leverage and taking of imprudent risks.

Awards under our short and long-term incentive plans do not provide for accelerated vesting upon a change-in-control.

Awards under our long-term incentive plan do not provide for accelerated vesting in creatingthe event of a termination of employment by Alleghany, other than on a pro-rated basis for time employed during the performance period.

-32-

We require our officers to own a substantial amount of our common stock, including five times base salary for Mr. Hicks, to ensure that they maintain a significant stake in our long-term success. In addition, our Named Executive Officers have significant exposure to Alleghany through unvested performance shares, the value of which depends upon the market price of our common stock.

We do not grant stock options to our officers. Our goal is to promote risk-adjusted long-term growth in the intrinsic value of our common stock and preserving stockholder value. Although we do not have a policywish to reward or punish our officers for exogenous short-term market price movements. We believe that a specified percentage ofover time intrinsic value will be reflected in the named executive officers’ compensation be performance-based, our objective is that a significant portion of their compensation be tied to Alleghany’s performance. In general, the proportion of the compensation that is performance-based is greater for our more senior named executive officers, reflecting their greater levels of responsibility and associated greater opportunity to contribute to the attainmentmarket price of our joint objectivescommon stock.

We have in place a compensation clawback policy applicable to our Named Executive Officers to further discourage imprudent risk taking.

Our general practice is to not provide perquisites or other personal benefits to our Named Executive Officers. In 2012, no Named Executive Officer received more than $10,000 in perquisites or other personal benefits.

The primary components of our 20102012 compensation program for our named executive officersNamed Executive Officers are summarized below.

Annual Compensation | Key Features | Purpose | ||

Salary | Fixed annual cash amount. | |||

| Annual Cash Incentives | The Compensation Committee establishes target annual incentive awards as a percentage of base salary for each The Compensation Committee determines individual results for participants and payouts based on, for more senior Named Executive Officers, overall financial and operational performance of management and, | Provides pay-for-performance component for achievement of shorter-term objectives. | ||

30

-33-

Annual Compensation | Key Features | Purpose | ||||

| Long-Term | Grant of | Provides pay-for-performance component focused on achievement of longer-term objective of increasing book value per share at | ||||

| Retirement Benefit | Completion of five years of service is required to receive any retirement benefit and payout of the full retirement benefit requires 15 years of service. Prior to January 1, 2011, the benefit payable under the retirement plan was based upon a formula that considered both annual base salary and annual cash incentives. Effective January 1, 2011, annual cash incentives earned for years subsequent to 2010 are not considered in the computation of the retirement benefit. Long-term incentives are not taken into account in computing retirement benefits. | Provides a | ||||

| Savings Benefit under Deferred Compensation Plan | Annual credit of an amount equal to 15% of base salary. | Provides a stable component of total compensation. | ||||

31

-34-

Additional information regarding Alleghany’s 2012 results, including audited consolidated financial statements, as well as management’s discussion and analysis with respect to 2012 results, is contained in Alleghany’s Annual Report on Form 10-K for the year ended December 31, 2012, which was filed with the SEC on February 21, 2013. Readers are urged to review such Form 10-K for a more complete discussion of Alleghany’s financial performance.

-35-

Alleghany Long-Term Performance

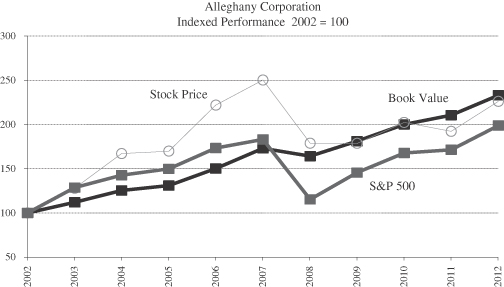

We believe that Alleghany’s performance is best measured over the long-term. In this regard, the chart below summarizes Alleghany’s performance over the ten-year period from December 31, 2002 to December 31, 2012, with all values indexed to December 31, 2002. During the ten-year period, Alleghany’s common stockholders’ equity per share increased at a compound annual rate of 8.9%, compared with a compound annual rate of return of 7.1% for the S&P 500, and Alleghany’s share price (adjusted for stock dividends) appreciated at a compound annual rate of return of 8.5%.

Alleghany’s performance during this period occurred during a time of re-invention and major change in the focus and geographic scope of Alleghany’s operating subsidiaries. At the time Mr. Hicks joined Alleghany in October 2002, Alleghany consisted of approximately $900 million of cash and liquid investments at the holding company level and $500 million of capital deployed in several U.S.-based operating subsidiaries engaged in disparate businesses, including an industrial minerals business (Alleghany’s largest subsidiary at the time), a steel fastener import and export business, a Midwest-based regional property and casualty insurer, and a

-36-

landowner in the Sacramento, California region. Since then, Alleghany has divested the industrial minerals business and the steel fastener import and export business. In 2012, Alleghany completed the acquisition of Transatlantic. At year-end 2012, Alleghany had approximately $1.0 billion of cash and liquid investments at the holding company level, with approximately $6.4 billion of capital deployed at operating subsidiaries, substantially all of which were engaged in the global reinsurance business and specialty property and casualty insurance business. During this period, stockholders’ equity in Alleghany increased to $6.4 billion at December 31, 2012 from $1.4 billion at December 31, 2002.

Summary of Recent Changes and Adjustments

to Executive Compensation Program in 2013

Subsequent to our acquisition of Transatlantic in March 2012, the Compensation Committee undertook a review of Alleghany’s executive compensation program and process to ensure that it continued to support the objectives and principles discussed on pages 32 and 33. As part of this review, in September 2012 after a competitive process, the Compensation Committee selected a new compensation consultant, Frederic W. Cook & Co, Inc., or “FW Cook.” As part of its determination to select FW Cook, the Compensation Committee reviewed and assessed the independence of FW Cook as a firm and the individuals providing advice to the componentsCompensation Committee. The Compensation Committee determined that FW Cook as a firm and the relevant individual advisers were independent.

At the direction of the Compensation Committee, FW Cook reviewed our executive compensation described above, Weston M. Hicks,program and process, including by meeting with the Compensation Committee and with members of management. In December 2012, although FW Cook concluded that our existing compensation program was simple and effective in supporting Alleghany’s Presidentcompensation philosophy and chief executive officer, will participate during 2011 inbusiness strategy, FW Cook recommended some refinements for consideration by the ACP Incentive Program. The ACP Incentive Program was establishedCompensation Committee. After further discussion regarding these recommendations with FW Cook and management, the Compensation Committee at its January 2013 meeting adopted some of the recommendations and took additional actions with respect to our 2013 compensation program. A summary of the significant changes and actions taken by the Compensation Committee which will affect compensation in January 20112013 and future years, includes:

Annual Incentive Plan

The concept of a target and maximum annual incentive opportunity under the 2010 MIP which was approved by stockholders athas been eliminated for all participants in favor of a single target bonus opportunity. This revision removes upside/leverage from the 2010 Annual Meeting,MIP and recognizes the subjective nature of evaluating

-37-

annual financial and individual performance in a long-term results-oriented company like Alleghany. In addition, in light of the greater volatility and larger catastrophe exposure Transatlantic brings to provide performance-based incentives, determined on a rolling three-year basis, to select officers of Alleghany and to parallel the investment personnelfour-year measurement period for performance shares awarded under the 2012 LTIP, the formula used to calculate the level of funding for the MIP Pool was revised to use a four-year, rather than a three-year, average catastrophe loss experience for each of Transatlantic and RSUI.

Long-Term Incentive Plan

For our subsidiary Alleghany Capital Partners,more senior officers (Messrs. Hicks, Brandon, Dalrymple and Gorham), long-term incentive opportunities in 2013 will continue to be denominated solely in performance shares, the employeespayout of which is based on achievement of the specified performance goal of growth in book value per share. For Mr. Borrelli and other Alleghany officers, 2013 long-term incentive opportunities will be evenly divided between performance shares and shares of time-based restricted stock which cliff-vest four years from date of grant. This move to time-based vesting for a portion of the long-term incentive opportunities for these officers recognizes that they have less ability to impact Alleghany’s overall long-term financial performance, while also providing a retention element to their compensation, particularly in years where performance share payout thresholds are responsible, undernot met.

The Compensation Committee also increased the book value per share growth target for performance shares for the 2013-2016 award period to 7% from 6% and increased the threshold percentage below which no payout will be made to 5% from 3.5%. In addition, the Compensation Committee revised the calculation to be used in determining whether the required growth in book value per share has been achieved to eliminate the adjustment for performance relative to the S&P 500 Index (as described on pages 45 and 46).

Finally, the target performance share award for the 2013-2016 award period for Mr. Hicks’ supervision,Hicks was increased to 300% of salary from 200% and for group-wide equity investmentsMr. Brandon was increased to 200% from 160%. These target increases reflect the Compensation Committee’s consideration of the transformative increase in size and complexity of Alleghany and its subsidiaries.

-38-

For open award periods, Mr. Hicks has the following outstanding equity-based awards, consisting of performance share awards made under the 2007 LTIP and other related compensation tables, notes and narrative appearing2012 LTIP:

Grant Date | Award Period(2) | Hurdle Rate (%) | Estimated Future Payout (# of Shares) | Estimated Future Payout ($)(1) | ||||||||||||||||||||||||||||||||||

| Threshold | Target | Maximum | Threshold | Target | Maximum | Threshold | Target | Maximum | ||||||||||||||||||||||||||||||

Jan. 18, 2010 | Jan. 1, 2010 – Dec. 31, 2013 | 3.5 | 6.0 | 8.5 | 2,295 | 7,650 | 11,475 | $ | 762,766 | $ | 2,542,554 | $ | 3,813,831 | |||||||||||||||||||||||||

Jan. 18, 2011 | Jan. 1, 2011 – Dec. 31, 2014 | 3.5 | 6.0 | 8.5 | 1,999 | 6,663 | 9,995 | 664,354 | 2,214,515 | 3,321,772 | ||||||||||||||||||||||||||||

Jan. 17, 2012 | Jan. 1, 2012 – Dec. 31, 2015 | 3.5 | 6.0 | 8.5 | 2,641 | 8,804 | 13,206 | 877,829 | 2,926,097 | 4,389,146 | ||||||||||||||||||||||||||||

Jan. 15, 2013 | Jan. 1, 2013 – Dec. 31, 2016 | 5.0 | 7.0 | 9.0 | 5,619 | 11,237 | 16,856 | 1,867,365 | 3,734,729 | 5,602,094 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

Total |

| 12,554 | 34,354 | 51,532 | $ | 4,172,314 | $ | 11,417,895 | $ | 17,126,843 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

| (1) | Based on the average price per share of common stock on December 31, 2012 of $332.36. |

| (2) | Does not include 29,877 shares of restricted stock awarded as a challenge grant in December 2004. On February 21, 2013, the Compensation Committee determined that the performance goal for such award had been achieved as of December 31, 2012 and, as a result, these shares vested and were paid out in February 2013. The terms of this award are described on page 56. |

See “Long-Term Equity Based Incentive Compensation — 2012 Awards” on pages 5044 through 6946 for general information regarding the terms of this proxy statement, which provide detailed informationperformance shares awarded under Alleghany’s long-term incentive plans.

Compensation Committee Process

At our Annual Meeting of Stockholders in April 2012, we conducted an advisory vote on the compensation of our named executive officers.

32

33

-39-

| (c) | ||||||||||||

| Number of | ||||||||||||

| (a) | Securities Remaining | |||||||||||

| Number of | (b) | Available for Future | ||||||||||

| Securities to be | Weighted-Average | Issuance Under | ||||||||||

| Issued Upon Exercise | Exercise Price | Equity Compensation | ||||||||||

| of Outstanding | of Outstanding | Plans (Excluding | ||||||||||

| Options, Warrants | Options, Warrants | Securities Reflected | ||||||||||

Plan Category | and Rights | and Rights | in Column (a)) | |||||||||

| Equity compensation plans approved by security holders(1) | 163,800 | (2) | $ | 234.55 | (3) | 306,335 | (4) | |||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||

| Total | 163,800 | $ | 234.55 | 306,335 | ||||||||

34

35

36

37

38